Wheat Market Update - Global Markets Move Up, Limited Gains in the UK

Monday 2nd September 2024

Welcome to this week’s market update! Each week, we'll delve into the market movements and key factors affecting wheat prices. Whether you're a fellow industry professional, a supplier, or simply interested in what’s happening in the market, our updates will offer valuable insights to keep you ahead of the curve.

Global Focus

Last week saw a notable upswing in global grain futures, with wheat leading the charge. MGEX wheat futures jumped by 33 cents, CBOT wheat climbed by 31 cents, and Matif wheat increased by €11. This rally was spurred by strong export activity for both wheat and corn, alongside renewed buying interest from China for US soybeans. The market was further buoyed by concerns over a mid-week heatwave threatening the soybean crop, leading traders to cover their short positions ahead of the long weekend in the US and Canada.

In Europe, wheat prices found additional support due to ongoing reports of reduced crop yields in northern regions, coupled with farmers' hesitancy to sell at current prices. With old crop stocks dwindling, there is increased pressure on the market to engage farmers, especially following a period of steady consumer purchasing. Although the euro has weakened against the US dollar, theoretically improving the competitiveness of EU wheat on the global stage, demand for northern European wheat remains subdued.

SovEcon has reduced its forecast for the Russian wheat crop to 82.5 million tonnes, likely due to lower yields from spring wheat. Ukrainian wheat exports continue at a strong pace, with Romania and Bulgaria also actively shipping grain. However, demand from North Africa and the Middle East remains limited, though Egypt is expected to re-enter the market soon, with most buyers looking to secure supplies from November onwards. In the southern hemisphere, Brazil has made progress on its wheat harvest, with around 10-15% completed. Meanwhile, Argentina's crop conditions have improved, pointing to a healthy 18 million tonne harvest, and Australia is on track for a strong production season.

UK Focus

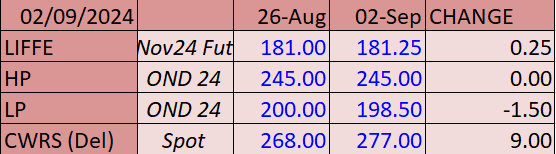

In the UK, the wheat market showed some resilience towards the end of last week, bouncing back after setting new contract lows earlier. By the close of trading, November 2024, London wheat had firmed up to £181.25, with May 2024 and November 2025 contracts closing at £193.55 and £191.80, respectively. While this was a modest recovery, the UK market's performance lagged behind the French Matif market, which increased by €7 (3.4%), and US Chicago wheat, which rose by more than 4%. This discrepancy can be partly attributed to the strength of the British pound against the euro and the US dollar, as currency markets anticipate that interest rates will decrease more quickly in the US and Europe than in the UK. Additionally, there is a growing awareness that UK wheat prices are relatively high compared to other global sources, which may be dampening demand.

Physical trading within the UK has been slow, with prices generally falling short of growers' expectations. However, milling premiums remain strong, driven by the availability of imported wheat with higher protein levels, which is priced only slightly above UK wheat. Among the 700 samples of Group 1 wheat tested, the average protein content was 12.44%, with 70% of the samples meeting or exceeding 12.0%. The lower protein levels in biscuit wheat and the widespread presence of ergot are complicating the market. Here at the mill, new crop milling wheat has been steadily flowing in. So far we are seeing protein averages between 12.5% and 13.0%, with hagbergs sitting at 380 and hectolitre weights at 79 kg/hl.

As of August 28th, 88% of the wheat area had been harvested. However, recent wetter weather has led to delays in harvest in the west of the UK and Northern Ireland.

Summary

Global Grain Futures Rally

Global grain futures saw a significant increase last week, with wheat leading the charge. MGEX wheat futures rose by 33 cents, CBOT wheat by 31 cents, and Matif wheat by €11. Downward revisions to EU yield and crop estimates helped global grain prices to rise last week, despite Black Sea wheat remaining highly competitive into key markets. Stronger than expected US export sales, buying by speculative traders, plus a weaker US dollar also added support

European Wheat Prices Supported by Yield Concerns

Wheat prices in Europe were bolstered by reports of lower crop yields in northern regions and farmers' reluctance to sell at current price levels. However, despite a weaker euro making EU wheat more competitive, demand for northern European wheat remains limited.

Mixed Prospects in Global Wheat Supply

SovEcon has reduced its forecast for the Russian wheat crop to 82.5 million tonnes due to lower spring wheat yields. Meanwhile, Ukrainian exports remain robust, and Brazil, Argentina, and Australia are all progressing well with their wheat harvests, indicating strong production from the southern hemisphere.

In the UK, Milling premiums are holding steady. However, issues like variability in proteins and ergot contamination are complicating things. Farmers are currently unhappy with wheat prices with many reluctant sellers. As of 02.09.24 there are currently a shortage of spot sellers, which is helping push premiums up. The UK market made smaller gains than those seen in the global markets, possibly linked to a lift in the strength of sterling against the euro.