Wheat Market Update - Markets Push Up

Tuesday 17th September 2024

Welcome to this week’s market update! Each week, we'll delve into the market movements and key factors affecting wheat prices. Whether you're a fellow industry professional, a supplier, or simply interested in what’s happening in the market, our updates will offer valuable insights to keep you ahead of the curve.

Global Focus

Wheat prices edged higher last week as tensions escalated in the Black Sea region. Ukraine last week accused Russia of using a strategic bomber to target a Turkish civilian grain vessel in Black Sea waters near Romania. This helped support global prices. In Europe Strategie Grains has cut its estimate for the EU-27 wheat crop by 2.1 Mt to 114.4 Mt, Driven by very wet weather in France and Germany.

The USDA released its latest WASDE Report on Thursday. Ukraine and Australia have both seen upward revisions in their wheat production numbers, as well as global wheat ending stocks increased. They have also pegged the wheat production numbers for this season's UK crop at 10.85 million tonnes, down considerably from last year (as was expected)

The lack of rain in Russia and Ukraine is starting to cause some concern for Winter wheat plantings.

Consultancy IKAR has reduced its estimates for the Russian 2024 crop to 82.2 million tonnes. Dryness persists in the Central US and Brazil, with limited rain forecast for the next two weeks.

Speculative traders have also recently reduced their net-short positions in key grain and oilseeds markets amid increased uncertainty and the building of more risk premiums. Recent drier weather in the US and the drought in Brazil are key factors for corn and soybean market prices pushing up, as are the drops in EU crop estimates and the size of black sea grain crops.

A net short position is when an investor holds more positions expecting an asset's price to decrease than to increase, effectively betting that the price will go down.

UK Focus

The physical market in the UK remains slow, with limited buying and selling. Challenges continue with lower proteins on the Group 3 and 4 wheats and this season's Ergot problem.

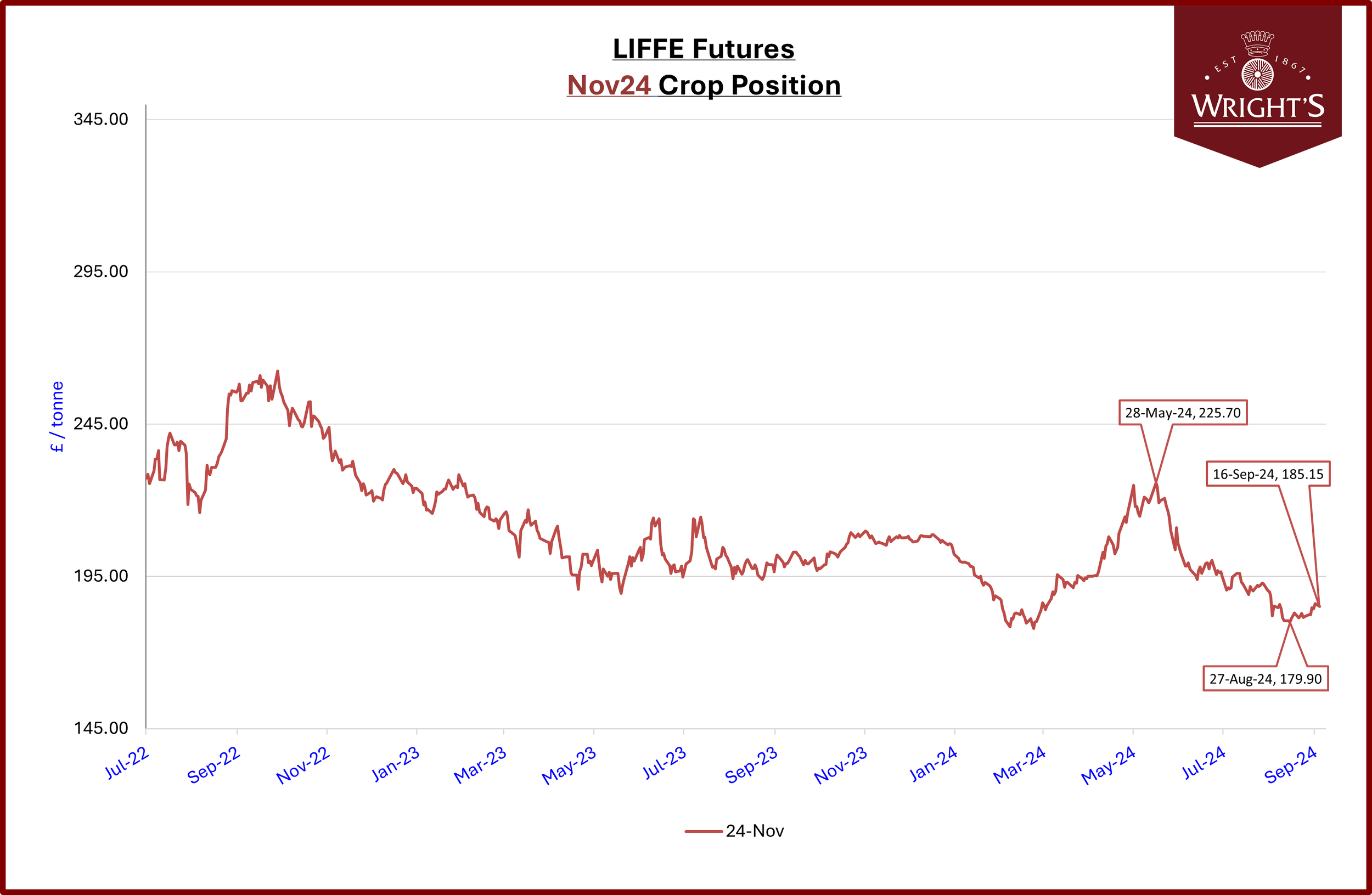

UK feed wheat futures for November 2024 gained £4.25/t over the week (Friday to Friday) to close at £186.05/t, tracking global wheat prices. Similarly, the contract for May 2025 closed at £199.50/t, up £3.75/t over the same period.

Summary

Markets have become more unsettled over the last few weeks. Increasing geopolitical tensions, weather concerns in key areas and downward revision of crop output numbers are pushing prices up.