Wheat Market Update - 26th March 2025

Welcome to this week’s market update! Each week, we'll delve into the market movements and key factors affecting wheat prices. Whether you're a fellow industry professional, a supplier, or simply interested in what’s happening in the market, our updates will offer valuable insights to keep you ahead of the curve.

Market Report

UK Market

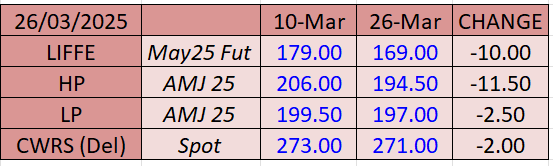

UK feed wheat futures (May-25) closed at a new contract low of £169.00/t yesterday, down £1.85/t from Monday’s close. The Nov-25 contract fell £3.00/t over the same period, ending the session at £187.25/t.

Old Crop prices continue to be depressed, with premiums dropping further. General oversupply in the UK market, news of a ceasefire and good weather are all contributing to the downward movement of the market.

For the 2024/2025 season, the UK wheat area has expanded to approximately 1.6 million hectares, an increase facilitated by favourable planting conditions compared to the previous year. This expansion is projected to result in one possible estimate putting wheat production of about 12.5 million tonnes, assuming average yields of 7.8 tonnes per hectare.

However, we are now in a key growing stage of the crop, and weather conditions will need to be fair in order to help achieve this.

Global Market

Wheat and corn futures slid as Russia agreed on a deal to ensure the safety of vessels in the Black Sea, enabling a removal of the risk premium allocated to allow for the knock-on effects of the Ukraine war.

Russia and Ukraine agreed, in talks with the US aimed at brokering peace, “to ensure safe navigation, eliminate the use of force, and prevent the use of commercial vessels for military purposes in the Black Sea”, the White House said.

The US has in return agreed to “help restore Russia’s access to the world market for agricultural and fertilizer exports, lower maritime insurance costs, and enhance access to ports and payment systems for such transactions”, the statement said.

The lower risk of disruption to Black Sea shipping, and wheat appeared as progress towards resolving the Ukraine war, encouraged a removal of risk premium in grain markets, even though neither Russia or Ukraine has significant stocks left to export in 2024/25.

Additionally, grain prices came under pressure due to forecasts of rainfall in the Black Sea region. The expected rain may ease recent drought conditions and support the development of winter crops as spring approaches.

Wheat prices were also impacted negatively by a stronger US dollar, making American grain exports less competitive globally.