Wheat Market Update - 11th March 2025

Welcome to this week’s market update! Each week, we'll delve into the market movements and key factors affecting wheat prices. Whether you're a fellow industry professional, a supplier, or simply interested in what’s happening in the market, our updates will offer valuable insights to keep you ahead of the curve.

Market Report

Global Market

Global wheat prices have generally trended downward since mid-February. This decline has been driven largely by the introduction of US tariffs and improved weather conditions across major wheat-growing regions (especially in the US and Russia). Higher tariff tensions increase trade risks, including for commodity prices, and growers will receive lower prices. These improved weather conditions are beneficial as crops enter critical developmental stages.

The ratings for the French wheat crop were increased slightly while the Australian Bureau of Agricultural & Resource Economics increased their estimate of the wheat crop from 31.9 million tonnes to 34.1 million tonnes.

Last week in France, mild and sunny spells have been favourable for crops but concerns over the impact of heavy rains over the last few months remain. Soils in the country reportedly remain waterlogged, and as a result, it is expected that certain areas of wheat will need to be re-planted.

Despite a downward price trend, it's important to remember that global cereal stocks remain tight. Any production issues from significant cereal producers could quickly lead to upward pressure on market prices.

Canadian wheat prices have also fallen, influenced by a weakening US dollar. Initially strong against the pound following Trump’s election, the dollar's strength has diminished as markets recognise potential short-term drawbacks of US tariffs. Combined with falling prices on the Minneapolis Grain Exchange (MGEX), this has further contributed to the recent drop in Canadian wheat prices.

UK Market

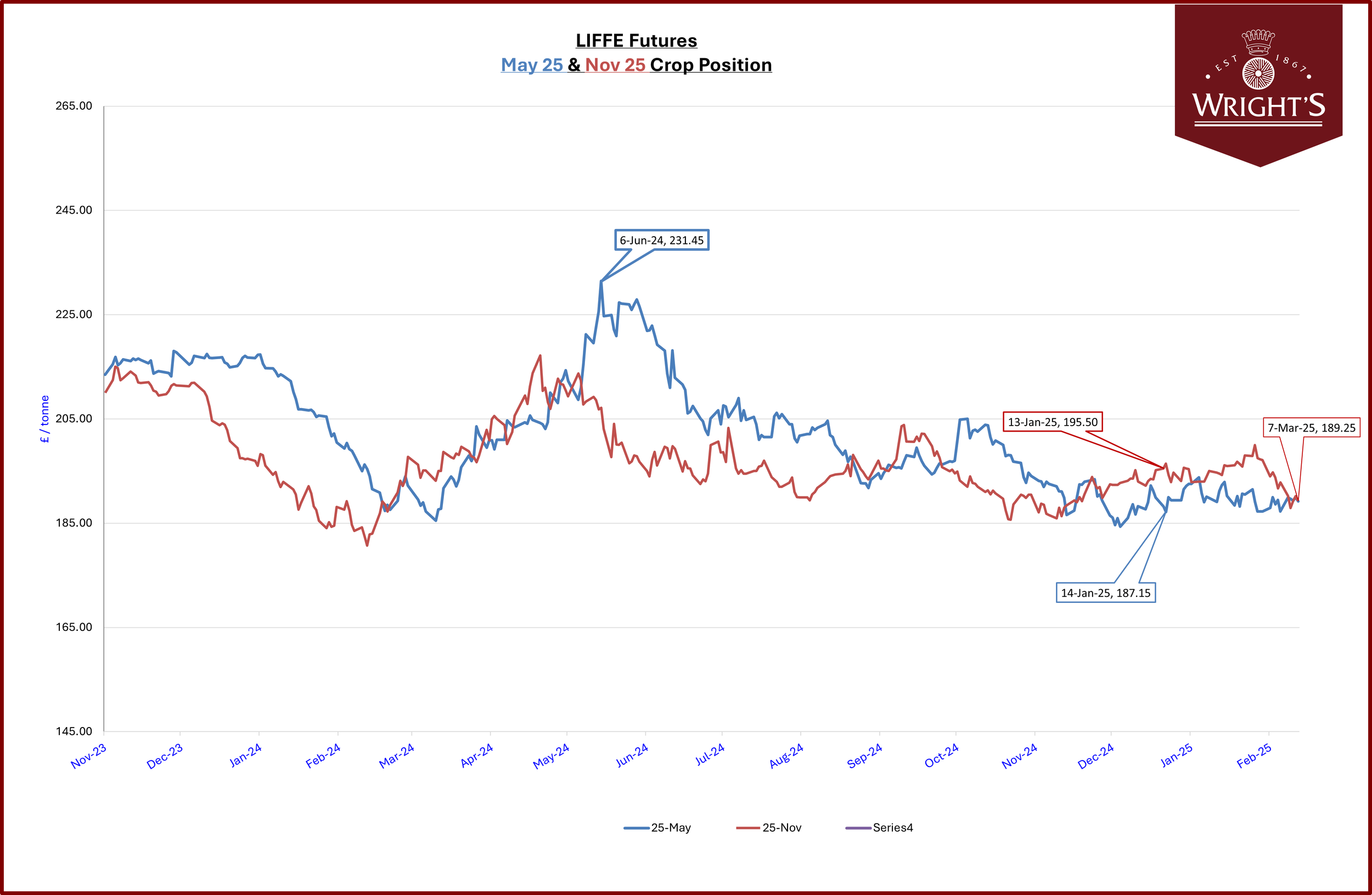

Old Crop Milling wheat premiums continue to face downward pressure, primarily due to sustained import levels. With significant volumes of old-crop wheat remaining unsold, some farmers have chosen to hold onto their stocks, anticipating better market conditions. Currently, New Crop milling wheat premiums are around £9 per tonne above the May 25 Premium. Given the existing oversupply, there remains the potential for further declines in these old crop wheat prices.

Looking forward to new crop, planting conditions have been favourable this season, resulting in an increased area of winter wheat being planted. This suggests we could see a larger wheat harvest compared to last year, provided the weather remains stable. We are now entering a weather-sensitive market period and so any significant weather event could rapidly influence market sentiment and pricing.

Soft wheat premiums remain high, and availability remains generally poor. There has certainly been more drilled for this coming season, so hopefully, this will alleviate availability.